SUI

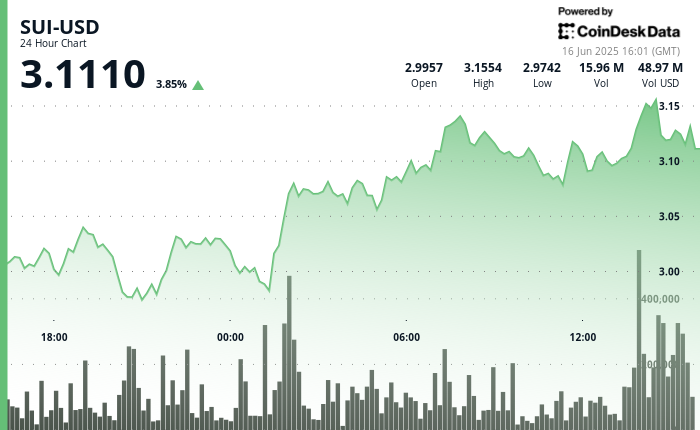

traded at $3.1110 on Monday, rising 3.85% over the past 24 hours following a multi-hour uptrend that pushed the token through key resistance levels. The asset hit a session high of $3.1554 before settling just above $3.11, with strong volume supporting the breakout attempt.

Michaël van de Poppe called SUI “super interesting as an ecosystem” in a post on X earlier Monday, pointing to several major on-chain milestones. The stablecoin supply on the Sui network has grown from $400 million in January to nearly $1.2 billion. Meanwhile, total value locked (TVL) has reached $1.8 billion — ranking third among non-EVM chains. Wallet adoption is also accelerating, helped by the integration of Phantom and the launch of Slush, the rebranded SUI wallet.

SuiLend, the protocol’s lending platform, has seen its TVL surge 90% over the past month to more than $600 million. Van de Poppe noted that this growth, coupled with previous bullish chart behavior, may set the stage for a strong breakout if SUI can close above $3.30. He described that level as a key liquidity zone that could spark a move to new highs.

The analysis period also showed strong buyer engagement, particularly around $3.12. Price briefly consolidated after the peak but continued to form higher intraday lows — suggesting continued momentum despite a modest cooldown from session highs.

Technical Analysis Highlights

- During the analysis period, SUI traded between $2.9742 and $3.1554, marking a 6.09% intraday move.

- Price formed a consistent uptrend, breaking above $3.08 resistance with support establishing at $2.96–$2.97.

- Volume exceeded 12 million units between 01:00 and 07:00 GMT, confirming broad accumulation interest.

- At 13:56 GMT, SUI surged through the $3.12 level on a volume spike over 1 million units, initiating a breakout.

- Between 13:56 and 14:03 GMT, price action remained strong and formed a new support band around $3.12.

- Toward the end of the analysis window, SUI advanced from $3.09 to $3.13 in a 1.29% move, closing with bullish continuation patterns intact.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.